[I promise to get back to the libertarian-blogging next week; I just got less writing time than I hope these past few days.]

I’m still quite stunned by the GOP primary contracts at Intrade.

As of this writing, you can buy Romney for 89 cents on the dollar. Now, let me be clear. I’m not saying that’s a solid value play. I’m saying that’s an incredible value opportunity, a potential 21% annualized return on any money you invest now (the contract expires at the convention, which is just under 7 months away).

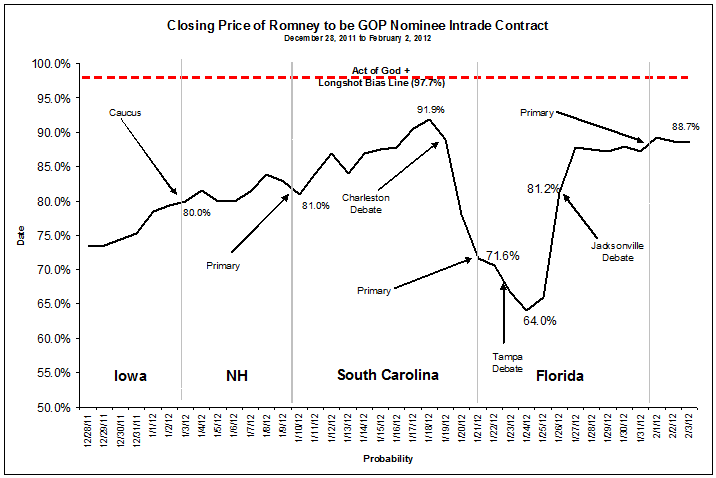

It’s even scarier to see it expressed as a time series. Here’s a graph of Romney’s Intrade closing prices since December 28, when I made a public declaration that the race was, for all intents and purposes, over.

So what is going on here; why is Romney so seemingly undervalued. I see a few things. First, two legitimate issues:

1. There’s some (small) chance he loses the primary. This isn’t a risk free investment — Romney could still be beaten, straight-up — but the odds of that are simply nowhere near 11%. Not a chance. But they are something. I don’t think they are greater than 1-2%. So let’s call it that, 2%.

2. Something could happen to Romney. People do die, and massive scandals do happen. Upon occasion. One way to estimate the marginal probability is to look at President Obama’s Intrade number for winning the Democratic nomination, which may incorporate things like the probability of death or massive scandal, but certainly does not include any chance of losing the nomination in a competitive primary. The President’s number is 97.7%, which means that it’s probably safe to say that in the case of the GOP primary, those last 2.3% are systemic, not anything to do with Romney himself. I have the 97.7% line marked in red on the graph; that shaves another 2.3% off his chances.

And now, three irrational issues (i.e. money-making opportunities):

2. Market distortions, mostly longshot bias. That 2.3% from above isn’t all about something happening to Romney. It also contains at least one market distortion: longshot bias, which I wrote about last month. This is a well known empirical finding of economics research into gambler behavior: gamblers like to bet on longshots rather than favorites, in part due to psychological utility of hoping for big paydays and in part due to cognitive misunderstanding of large numbers. The upshot is that it attenuates the odds whenever the odds are set by the market, be it at the Saratoga Race Course or on the Intrade political market. But, as I said, this is built into the 2.3% we’ve taken from Obama’s Intrade Odds. That’s why the red line on the graph is labeled “Act of God + longshot bias.”

Still, there are a few other market distortions worth noting here: for instance, the market might itself have an influence on the outcome of the race, and thus partisan backers of one candidate or another might have reasons to manipulate it. I don’t think a lot of people are looking to Intrade to see if the race is over, but would it really be that bad of an investment for the Gingrich or Santorum campaign to spend a few thousand dollars driving down the price of Romney? It’s not a huge-volume market. It couldn’t hurt. If there are voters or journalists out there who are using Intrade as a cue, then it might actually be a very smart strategy.

3. Actors incentives to continue to make it a race. As I’ve written before, virtually everyone — but particularly the media — has a strong incentive to portray the race as not over. That is probably playing a role here, even if its just putting a hint of doubt into people’s minds.

4. The polling. There was a long (and wonderful) nerdfight earlier this year on the internet over the relative importance of polling and, on the other hand, fundamentals like money, organization, and party actor endorsements in predicting the outcome of elections. My personal opinion is that in primaries, both are relevant, but fundamentals are more important. Others disagree. But anyone who puts more weight on polling is bound to see the race as still not in the bag. And that’s probably a sizable percentage of people, even in the chattering class. I mean, just look at that graph. It follows the media narrative and state-by-state polling to a ridiculous degree.

So, in sum, I think it’s something like this: Romney is at 88.7 right now. If he were a lock absent the act of god, he’d be around 97.7 or so, but that contains the longshot bias, so there’s some value in there. But call it 97.7 So we have to explain about 9% among other market distortions, actors actively trying to make a race where there isn’t one, people putting too much reliance on polling and not enough on fundamentals, and Romeny’s actual chance of losing the election in some way other than death. I’m of the mind that the vast majority of the 9% is illusory (as I said, I would estimate his true chance of losing at less than 2%). How you divide up the rest is probably a question of philosophy, or at least a better social scientist than I.

But make no mistake about it, this thing is over. And people who refuse to believe this are handing out cash right now on Intrade. Not, of course, at the 21% annualized return we discussed above, that would be if we knew Romney was 100% to win. But by the back of the envelope we’ve done here, it’s at least a 12% annualized return, plus (12/7) * whatever the longshot bias is. Needless to say, my recommendation is, as it has been, BUY.

I’ve done some trading on InTrade. My feeling with buying a contract at something like 87.5% is that the upside is small compared to what you could lose. Percentage-wise it’s a great investment if it all goes to plan, but unlike stocks, if Romney somehow doesn’t become the nominee, the value of the contract goes all the way down to zero and you lose all your money (whereas most stocks, unless the company suddenly goes totally bust, will lose some but not all their value). Additionally, if you buy a bunch of these contracts it means that your money is tied up until the summer, and you have less to put elsewhere.

Buying something low and (hopefully) undervalued means that you have little to lose and a whole lot to gain. This makes it a bit more like gambling than investing, but hopefully you’re making purchases based on analysis rather than pure hunches, and you’re not just relying on luck to make your “longshots” come in.

I see the point, but that’s almost the perfect expression of longshot bias. Check out my previous post on that; I agree that Intrade is not exactly the stock market, but that’s kind of the point. It’s much more like the betting pools at the horse track.

thanks for the comment.

I think there is also an InTrade effect in play here. I’ve never traded on the site, but I’ve looked at it – including again a few months ago when Romney was in under 70%. For me, the monthly transaction charge plus the low volumes reduce the upside quite a bit. At $5 per month, that’s 6 of 7 months worth of charges until the market settles after the GOP convention – so call it $30 in costs that you’d have to make up. There are also other charges depending on how you deposit or withdraw your funds, but I think you can avoid some of those.

Then there is the market size. Right now there are 13 Romney shares that can be bought. Last time I looked, it was 8. I’ve seen as few as 5. So even if you wanted to realize the 12% risk adjusted annualized return, you’d be very limited in the scope in which you could do so. And, I would suspect that if you bought all the shares on sale, you’d quickly move the market yourself to the point where you’d drive that return closer to zero.

By my math, I’d have to buy something like 300 shares at the current price of 8.89 and then settle them at $10 in order to make up the $30 while still accounting for the Act of God allowance. If there are 10 shares for sale each time I look for some to buy, I’ll need 30 transactions. So the question would be whether those transactions would move the market to the point that made it uneconomic.

I could put this better if I thought about it more, but I think you’ll get the point.

Otherwise, Matt, I agree with your point and the undervaluing of a Romney win.

I agree that the monthly fee structure of Intrade strongly discourages low-volume traders. It’s a problem. However, the old system — which had a commission on each trade, but no monthly — was not problem free. In fact, it might have been worse, since it was a direct distortion of the market. I haven’t traded on Intrade since they swtiched over — I liked to place very selective trades there, and that was just completely incompatible with the monthly fee.

So I agree with you that there are more market distortions than the one’s I mentioned; the monthly fee and the potential lack of liquidity are definitely two of them.

Matt

As an update: Romney is is 8.21 and there are a good number of shares on offer (93 as of now). Seems like the right time to make the bet. 🙂

There’s also another 150+ shares available for less than 85 cents on the dollar. So yes, plenty of room.

$6.86. Just saying…